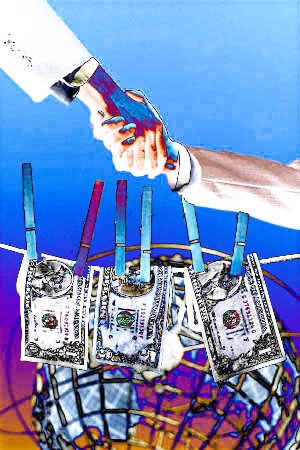

No drama Obama can’t apply to his economic team:

Paul Volcker, the former Federal Reserve chairman and adviser to the White House, on Thursday expressed continued doubts over the Obama administration’s plan for financial regulatory reform and lent his support to new taxes on banks.

In a sign of the on going struggle over the detail of the bill, Mr Volcker warned that the plan to deal with systemically important financial institutions contains a seemingly “intractable” problem — how to draw the dividing line between companies seen as ‘too big to fai’l and those that are not.

So Volcker’s just a crank and old coot. Yesterday’s man. After all, Tim Geithner assures the Duma and the sheople that just because Goldman, BofA, JP Morgan Chase and others are designated ‘Tier 1″, these firms, contra Volker don’t even have implicit recourse to federal assistance should they encounter ‘systemic risk.’ We are further invited to find comfort in Geithner’s assurance that he and his retinue of legal beagles guarantee increased oversight, scrutiny and thereby a self-imposed (almost Chicago school) ‘disincentive’ to grown into too big to fail.

It’s tragic that ‘healthcare’ consumes all the oxygen in the feeble American consciousness. The ill-considered, frankly self-contradictory and downright purely notional aspects of the Administration’s nimbus-like financial reform ‘plans’ make their affirmative assistance to Rightist inchoate revival seem flawlessly elegant. And despite what some readers here maintain, *that* reform is more important for the long term viability of this country than health care – this year.

Pollyanna’s continue to find a pony in the healthcare pile-up. We don’t see it. Perhaps Laurence O’Donnell — he was Chief of the Senate Finance Committee staff doncha know — will explain how Max Baucus, like Wiley E. Coyote, is a super genius. When we heard of direct tax payer subsidies to private insurance carriers (at their established non-competitive going rates) was reform in the name of ‘expanding coverage’, well it fit the Administration’s preference for corporatism with pep.

Lis Warren noted earlier this year:

“In addition to drawing on the $700 billion allocated to Treasury under the Emergency Economic Stabilization Act (EESA), economic stabilization efforts have depended heavily on the use of the Federal Reserve Board’s balance sheet. This approach has permitted Treasury to leverage TARP funds well beyond the funds appropriated by Congress. Thus, while Treasury has spent or committed $590.4 billion of TARP funds, according to Panel estimates, the Federal Reserve Board has expanded its balance sheet by more than $1.5 trillion in loans and purchases of government-sponsored enterprise (GSE) securities. The total value of all direct spending, loans and guarantees provided to date in conjunction with the federal government’s financial stability efforts (including those of the Federal Deposit Insurance Corporation (FDIC) as well as Treasury and the Federal Reserve Board) now exceeds $4 trillion.”

Liz adds now in Moore’s new movie that no one knows where the money went – not Congress, Treasury, the White House, etc. We’ve said it time and again – had Obama proved himself competent managing or at least accounting for that intergalactic clusterfrack he would have a reserve of good will or at least benefit of the doubt for health care. If we were picking stocks, we know where we’d be putting down.

[Young Intern to Elder Statesman] The President would love to see you, Mr. Volker. Is March 25, 2010 good for you? Or lessee, possibly five minutes private alone time after the Orthodox New Years dinner? That’s still open.

[Volker glares]

[Young Intern] I assure you, Mr. Volker, in the three years since I graduated from Reed College, I’ve never seen anyone respect you like the President does. I mean, represent!

[Phone intercom beeps]

[Young Intern] Can you just, I’ll be – hang on, just be a second . . .

[Dim echo from ear speaker] Get him out of here. We’re not going to rebuild his f***ing Chinese Wall . . .

[Young Intern]: China, Mr Emanuel?

[Dim echo from speaker] F*** me, are you retarded? A Chinese Wall? Well, you just tell Volker that Summers and Geithner are not going to allow him to rebuild what they tore down, can you do that, moron? We’re not going to take the hit on making the economy explode. Investment banks as commercial banks are here to stay as one, capiche?

[Young Intern cupping phone speaking to Volker] Sir, the President’s China policy is being reworked and his advisors believe it is better to move ahead with China than dwell on the past.

http://www.nytimes.com/2009/10/21/business/21volcker.html?ref=business

[Meanwhile Rahm screams for Gibbs] Where the f*** is Gibbs, get him. I want you by 5 this afternoon to find and make some link between Volker and Fox News. Then you f***ing leak it to Olbermann as an exclusive, got it? You screw this up, Gibbs, then YOU have to answer to Rubin, not me.