The immediate granular reactions to Obama’s budget, such as its ‘honesty’, education, EPA, armed forces personnel expansion, tax cuts, etc. are all important. We agree with the Center Left that the stimulus and budget are unlikely to generate the economic growth underpinning the budget’s out year projections. They are not audacious enough.

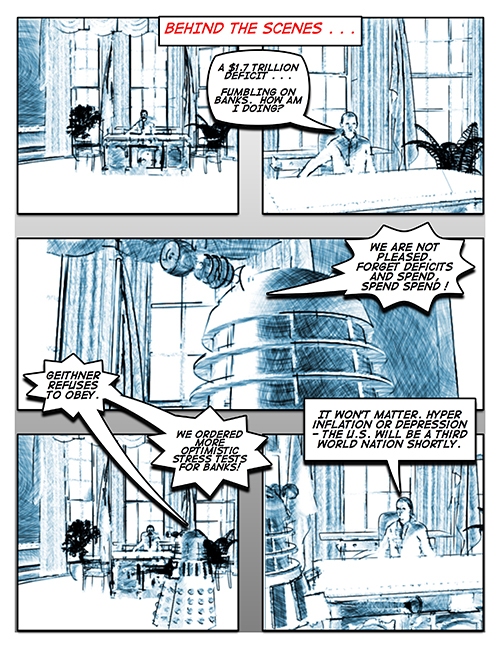

Geithner’s tepid approach to the banking crisis is probably a more revealing insight into the Administration’s psyche than the budget. He’s an odd pollyanna. His ‘worst case’ scenario of a 3.3% economic decline this year and flat 2010 followed by growth can only be a political prism divorced from economic reality. 2008 Q4’s over 6% decline merely highlights this.

AIG is on the precipice of tripartite tear down. CitiGroup and Bank of America/Merrill Lynch are insolvent as we speak for all practical purposes. Paul Volker correctly observed recently ‘some banks are too big to fail exist.’ The Administration’s expected increased government position in Citi is best seen as a band aid.

The Obama Administration is not nearly as honest as it needs to be. The banking/financial situation is far more important for future national expenditure possibilities than a budget. Which makes Geithner’s dithering on bank capitalization, ‘to nationalize or not dare use that word’ etc. all the more bizarre.

Our macro take despite the stakes is meh. Assuming American historical luck holds and we navigate a soft landing for banks and Obama’s budget is even 20% close to reality we believe American capacity for subsequent austerity to sustain deficit reduction is zero. American debt service obligations will be crippling by any objective standard. If the depression takes hold speed things up.

Sound American strategic foreign policy planning should begin to anticipate the existing and soon to explode ends means gap and adjust accordingly. Obama’s success or failure will only attenuate the timeline a bit.

“Mobile reactors impose an even more

extensive set of constraints. Mobile nuclear

reactors would preferably have:

– closed cooling and moderating systems

– nonhazardous and desirably inert

– helium, carbon dioxide, heavy water,

liquid metals acceptable; liquid salts deemed

not suitable due to hazard potential

– self-contained operations with minimal

heat or waste effluents

– largely robotic operation

– inherently safe operation

– negative void coefficient (that is, the

power reduces when the reactor core temperature

goes up)

– passive cooling (that is, loss of coolant

will not damage the fuel; the core temperature

eventually cools due to radiation and

convection); these characteristics preclude

Chernobyl and Three Mile Island–type

nuclear accidents

– resistance to terrorist attack. Tristructural-

Isotropic (TRISO)–fueled reactors are

attractive in this respect12

– resistance to nuclear weapon proliferation

possibilities

– breeder reactors produce plutonium and

violate U.S. policy

– breeder reactor safeguards to prevent fuel

pilfering, however, are possible and have been

employed in other countries13

– a convincing waste disposal

configuration

– resistance to explosive attack.”

http://www.ndu.edu/inss/Press/jfq_pages/editions/i52/11.pdf

Newt is melting right now – his current bombast is a mask – His insane Ben Franklin comment indicates a mental bulkhead could break any week now,

Barnett does seem off putting in his -insincere claims to liberalism when he was pushing his war on the world maps, his obvious relish for power and influence, and the banality of his management lingo.gaps, core, etc – retch

Wow, Aldershot, there should be a warning now on all this stuff — recalling this may be hazardous to all of our collective health lol. Amazing people really did think his ideas were worth spreading. Good point. This transcends even Crusher-esque weaselness. Michael Dorn as Worf should erupt into the video at say 3:25 and slam an atomic knee drop then exit without a word.

Just remembering being in the same room with TPB at Office of Force Transformation makes one want to reach for the bourbon at 8:45 AM. God bless Art Cebrowski but why he lent TPB his prestige and mentorship is still a puzzle.

All hail the cleaning out of old bookmarks !

Even Wesley wasn’t bad enough for this guy to be an ancestor:

http://www.ted.com/index.php/talks/thomas_barnett_draws_a_new_map_for_peace.html

(Coincidentally, I was cleaning out old bookmarks and was rewatching this…Barnett comes off as a total twit.)

Kudlow beats Tweety any day – Dodd should pray for this. The living in Iowa thing didn’t work to well.

http://www.vanityfair.com/online/wolcott/2009/02/o-pray-let-it-be-so.html

A great ep! And IIRC, another Wesley-induced mess. Perhaps Wesley’s ancestors worked for Citi or were related to Hank Paulson.

I’m reminded of The Next Generation episode in which the people surrounding Crusher are disappearing one by one, and in the end she must to leap head-first through the swirling space anomaly to safety.